Throughout history, lending has undergone a significant evolution, transitioning from ancient practices, such as those seen in Mesopotamian times, to the digital age. Digital lending has emerged as a game-changer, offering streamlined access to credit for individuals and businesses alike. Leveraging technology, digital lenders have revolutionised the borrowing process, making it faster, more accessible, and often more efficient.

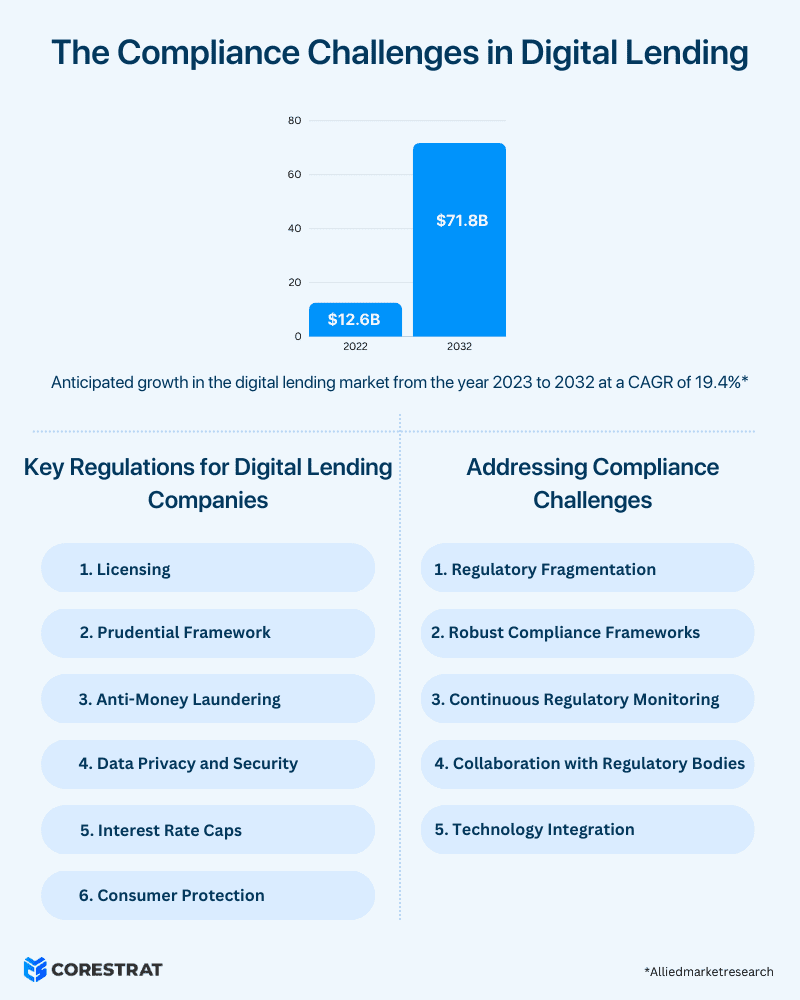

The integration of AI and ML technologies has significantly propelled the growth of digital lending. According to a study, the global digital lending market reached $12.6 billion in 2022 and is anticipated to soar to $71.8 billion by 2032, reflecting a remarkable CAGR of 19.4% from 2023 to 2032.

Digital lending platforms have transformed the borrowing experience by leveraging data analytics, AI-driven algorithms, and innovative underwriting models. These platforms have democratised access to credit, catering to underserved segments of the population and providing quicker, more convenient loan approval processes than traditional banks.

However, the digital lending sphere is not without its challenges, particularly when it comes to navigating a complex web of compliance regulations.

In this blog, we will discuss what are the compliance regulations around digital lending and some solutions how to address the industry’s challenges

What are the Key Regulations that Digital Lending Agencies Must Follow?

Just like any other financial institution, digital lending companies must comply with specific regulations to safeguard both end customers and the institution. Here are key compliances that these agencies must adhere to, while facilitating loans for eligible borrowers.

Licensing

Digital lending organisations mandatorily require licenses to operate, depending on the nature of lending activities and the jurisdictions they operate in. For example, in Singapore, lending activities are regulated by the Moneylenders Act, overseen by the Monetary Authority of Singapore, whereas in India, lending licences are issued and governed by the Reserve Bank of India.

Licensing needs vary based on loan types such as consumer, mortgage, small business/commercial, peer-to-peer, or payday lending. Obtaining these licences involves meeting specific regulatory criteria, including compliance with interest rates, consumer protection laws, and investor safeguards for lending. Adherence to licensing requirements ensures legal operation and compliance with lending regulations in different regions.

Prudential Framework

The prudential framework is a crucial aspect of compliance in digital lending. It serves as a regulatory guardrail, promoting responsible lending practices, mitigating risks, and safeguarding the stability of both individual lending institutions and the financial system at large.

It includes rules for capital adequacy to manage risks, liquidity standards for meeting obligations, risk management practices to mitigate lending risks, asset quality maintenance for potential loan losses, and governance ensuring compliance and prudent practices. This framework supports lender’s growth while averting instability, emphasising compliance for trust, financial strength, and regulatory adherence in lending institutions.

Know Your Customer (KYC)

Know Your Customer (KYC) compliance is a fundamental aspect of due diligence in the financial industry, including digital lending platforms for credit risk management. Know Your Customer (KYC) compliance in digital lending is about verifying customer identities, assessing transaction risks, and preventing financial crimes.

Digital lenders collect and verify customer information, conduct risk assessments, and monitor transactions for anomalies. This includes personal details, identification documents which are approved by the government authority (such as passports or driver’s licenses), and proof of address. Advanced technologies like biometric verification, facial recognition, or document authentication software might be employed for robust identity verification.

Enhanced due diligence is applied to high-risk customers, and compliance documentation is maintained. Reporting any suspicious activities to authorities is mandatory. KYC ensures customer verification, risk mitigation, and regulatory adherence, fostering a secure lending environment while preventing fraud and illicit activities. The digital lending platform must be capable of performing the KYC at ease to ensure convenience and ease of use for customers. KYC must be automated and integrated into the platform, with real-time updates to ensure accuracy.

Anti- Money Laundering

Anti-Money Laundering (AML) compliance in digital lending involves robust measures to prevent illicit financial activities. This aspect falls under Know Your Customer (KYC) compliance, primarily emphasising the monitoring and reporting of funds utilised for potentially illicit financial activities.

It includes verifying customer identities, monitoring transactions for anomalies, conducting risk assessments, maintaining records, and reporting suspicious activities. Compliance ensures legal adherence, safeguards the financial system, and prevents misuse of lending services for unlawful purposes. Digital lending platforms must prioritise AML compliance to maintain trust and security within the financial ecosystem.

Data Privacy and Security

Data privacy and security in digital lending revolve around safeguarding users’ sensitive personal and financial information. It encompasses transparent data collection with explicit user consent, strict adherence to data privacy laws like GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act), and secure storage through encryption and advanced cybersecurity measures to thwart potential breaches.

Ensuring user control and transparency in data usage, coupled with rapid response protocols for incidents, form key pillars in automated’ loan approval systems. Additionally, ongoing employee training on data handling best practices plays a pivotal role in fostering a culture of data security within digital lending platforms, enhancing trust and confidence among users while fortifying the lending ecosystem.

Interest Rate Caps

Interest rate caps in digital lending refer to the maximum allowable interest rates that digital lenders can charge on loans. These caps are imposed by regulatory authorities or laws and serve to protect borrowers from excessively high interest rates and predatory lending practices.

The caps can vary widely based on jurisdiction, loan type, borrower’s creditworthiness, or the amount of the loan. They may be fixed as a specific percentage or may fluctuate based on the prevailing market conditions or regulatory changes.

Adhering to interest rate caps is crucial for digital lending platforms to ensure compliance with the law and maintain ethical lending practices. While interest rate caps aim to protect borrowers, they also pose challenges for digital lenders in setting competitive rates that cover operational costs and risks while remaining within the legal limits.

Consumer Protection

Consumer protection forms the cornerstone of ethical digital lending practices, transcending mere regulatory checkboxes to uphold fair, transparent, and equitable borrower experiences. Regulations governing digital lending mandate fair practices devoid of discrimination, ensuring equal access to credit opportunities for all. Transparency in loan terms stands as a non-negotiable requirement, necessitating clear and comprehensive disclosures on interest rates, fees, and repayment details, empowering borrowers to make informed decisions.

Moreover, stringent measures against predatory lending practices are paramount, preventing lenders from engaging in exploitative tactics that could harm borrowers. Adhering to these regulations isn’t solely about compliance; it’s a moral obligation for digital lenders to prioritise consumers’ trust, well-being, and financial security, fostering a culture of responsible lending practices.

Addressing Compliance Challenges

Regulatory Fragmentation

Operating in the realm of digital lending means traversing a multifaceted regulatory landscape that varies vastly across jurisdictions, types of loans and the financial institution itself. Consider the lending regulations in India, overseen by the Reserve Bank of India (RBI), which sets the central guidelines for risk management. However, individual states within India may introduce their unique regulations for various loan types, aligning with RBI mandates. This multi-tiered regulatory framework poses complexities for digital lending platforms, compelling compliance with numerous regulations before approving loans for eligible borrowers. Similarly, different countries have different governing bodies and the digital lending platform should be flexible enough to be programmed to adhere to those regulations.

To tackle this complexity, digital lending platforms must employ dedicated compliance teams with expertise in lending regulations. They need to continuously monitor and adapt their strategies to align with evolving legal landscapes, while also fostering collaborative relationships with regulatory bodies in each jurisdiction. Ultimately, success in this intricate compliance maze hinges on orchestrating agile and tailored compliance strategies that harmonise with the diverse regulatory expectations in the vast area of digital lending.

Robust Compliance Frameworks

Digital lenders should prioritise establishing robust compliance frameworks, integrating automated systems for Anti-Money Laundering (AML) checks, Know Your Customer (KYC) verifications and data security protocols. These systems use advanced technology to swiftly detect suspicious activities, verify customer identities, and safeguard sensitive information.

Automation streamlines processes enhances accuracy, and ensures regulatory compliance. While automation is efficient, human oversight remains essential to maintain effectiveness and ethical application. Overall, this proactive approach reinforces trust, operational efficiency, and regulatory adherence within digital lending platforms.

Continuous Regulatory Monitoring

Digital lenders should stay updated with regulatory changes, by investing in dedicated compliance teams or partnering with RegTech firms. These teams monitor and interpret evolving regulations, adapting lending operations to align with the latest legal requirements. Dedicated teams analyse updates and liaise with regulatory bodies, while RegTech solutions provide technological support through automated compliance monitoring. These proactive approaches ensure agility, mitigate compliance risks, and demonstrate a commitment to maintaining a trustworthy and compliant digital lending environment.

Collaboration with Regulatory Bodies

Active engagement with regulatory authorities is crucial for digital lenders. Seeking guidance and clarification helps them stay informed about upcoming changes in regulations. This engagement allows lenders to anticipate shifts, adapt compliance frameworks, and align operations accordingly. Moreover, participating in policy discussions enables lenders to contribute insights and potentially influence regulatory decisions, fostering a collaborative environment beneficial for both lenders and regulators. This engagement builds transparency and rapport, creating a conducive regulatory landscape for digital lending.

Technology Integration

Leveraging advanced technology, like AI-driven compliance tools and encryption methods, significantly boosts compliance efforts in digital lending. There are many benefits of using AI and ML in fintech, among which automation is also one.

AI tools automate tasks such as Anti-Money Laundering checks and transaction monitoring, enhancing the efficiency of compliance teams and ensuring adherence to regulations. Encryption techniques safeguard sensitive data at all stages, strengthening data security and meeting data protection standards. Collaboration with RegTech firms offers specialised solutions for compliance needs. Altogether, these technological advancements streamline operations, adapt to regulatory changes, and reinforce the platform’s commitment to compliance and data protection in digital lending.

Conclusion

Digital lending’s transformative impact on the borrowing landscape is undeniable. However, the journey is rife with compliance challenges unique to the industry. Navigating these challenges demands a proactive approach, strategic investments in technology, and a steadfast commitment to regulatory adherence. As the digital lending ecosystem evolves, staying compliant with industry-specific regulations will continue to be a cornerstone of sustainable growth and trust-building with consumers. By embracing compliance as an integral part of their business strategy, digital lenders can pave the way for a more transparent, secure, and inclusive lending environment.

Digital lending’s growth trajectory is intertwined with its ability to adapt to regulatory demands. The ongoing evolution of regulatory frameworks presents both hurdles and opportunities. Digital lenders that proactively address compliance challenges are better positioned to thrive in this dynamic and promising landscape.

Corestrat’s Digital Lending Automation, an automated lending management system, ensures lending agencies have fewer compliance worries by handling the bulk of regulatory requirements within its system. This AI and ML-powered tool is customizable to adhere to governing body regulations and actively monitors customer interactions to ensure compliance. For more details visit: http://52.22.170.227/

Skip to content

Skip to content