Credit risk management is an essential part of any lending business. Traditionally, credit risk assessment has been based on key factors like credit score, income, and employment history. However, with the rise of technology and the availability of vast amounts of data, lenders are now able to look beyond traditional data sources and tap into alternative data to assess credit risk.

Alternative data refers to any information that is not typically included in a credit report, such as social media activity, utility bill payments, rental history, and more. By analysing this data, lenders can gain a more comprehensive view of an applicant’s financial behaviour and make more informed lending decisions.

Corestrat, a leading provider of data analytics solutions, has developed a cutting-edge product called Model.ai that leverages the power of alternative data to enable lenders and creditors to make risk-informed financial decisions. Model.ai uses advanced machine learning algorithms to analyse large amounts of non-traditional data and generate predictive models that can accurately assess an applicant’s creditworthiness.

Stay tuned for updates, news on finance & technology

Model.ai and Ecosystem Scores

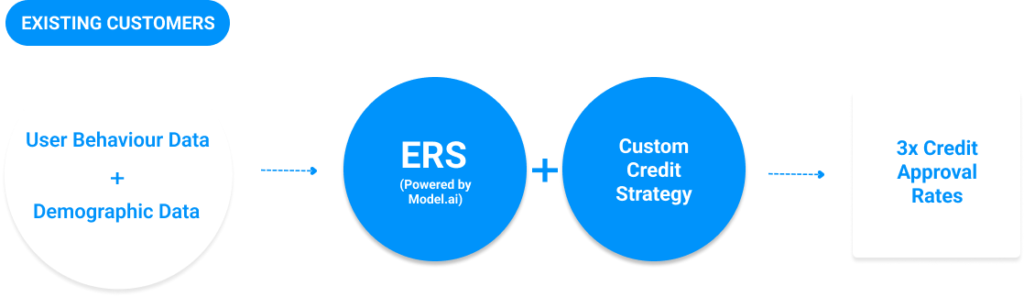

With Model.ai, lenders can access a wide range of alternative data sources, including social media, online behaviour, and payment history. By incorporating these non-traditional data points, lenders can gain a more complete picture of an applicant’s financial behaviour, which can help them make more accurate lending decisions. This is done through our proprietary Ecosystem Risk Score (ERS)

“Ecosystem scores” is a term that can refer to different types of scores used in various contexts. In the context of finance, ecosystem scores can refer to a measure of a customer’s overall financial health based on their interactions with various financial products and services within the broader financial ecosystem.

Our Ecosystem Risk Score (ERS) provides a comprehensive view of a customer’s experience with a business. They are created by aggregating various metrics related to customer engagement, including customer satisfaction, product usage, social media interaction, and more. By leveraging first-party data to create effective ecosystem scores, businesses can gain a more holistic understanding of their customers, identify areas for improvement, and develop strategies for delivering value and enhancing engagement.

ERS enables risk managers to reduce losses and increase revenue by predicting, assessing, and managing risk objectively.

Benefits of Using Alternative Data in Credit Decisioning and Risk Management

- Provides a more complete view of a customer’s financial behaviour and creditworthiness beyond traditional credit scores

- Helps identify customers who may be overlooked or underserved by traditional credit scoring methods, thereby expanding access to credit

- Enables more informed lending decisions by reducing risk and improving portfolio performance

- Facilitates more personalized and tailored financial advice and recommendations

- Can lead to more efficient and effective credit risk management processes, resulting in cost savings for lenders

- Enables businesses to gain valuable insights into customer preferences, behavior, and interests, which can inform product design and marketing strategies

- Enables businesses to identify and mitigate potential risks more quickly and effectively, reducing potential losses

Incorporating non-traditional data into credit risk management can be a powerful tool for businesses to improve their bottom line while simultaneously enhancing the customer experience.

Bottom Line

Alternative data has the potential to transform credit risk management, providing businesses with more comprehensive insights into their customers’ financial behavior and overall financial health. With the advent of new data sources and technologies, businesses can now leverage first-party data to create more effective ecosystem scores, which can improve decision-making and ultimately drive business growth.

By using alternative data in credit risk decisioning and management, businesses can reduce risk, improve portfolio performance, and expand access to credit for underserved customers.

At Corestrat, we believe in the power of alternative data to drive better business outcomes. Our product, Model.ai, leverages first-party data to help businesses make more informed lending decisions and manage credit risk more effectively. Whether you’re a financial institution looking to improve your lending practices or a business looking to gain a deeper understanding of your customers, Model.ai can help you achieve your goals.

So why wait? Contact Corestrat today to learn more about how alternative data can help transform your credit risk management practices and drive business growth.

Skip to content

Skip to content