In recent years, the advancement of artificial intelligence (AI) has revolutionised various industries, and the financial sector is no exception. One particular area where AI has made a significant impact is in the realm of loan approvals.

Traditional loan approval processes often involved tedious paperwork, manual analysis, and lengthy waiting periods which might take from days to weeks to complete the loan approval process. However, with the introduction of automated loan approval systems powered by AI, the lending landscape has undergone a dramatic transformation.

According to Allied Market Research, AI-powered digital lending solutions are projected to experience remarkable growth, with the market expected to reach $19.88 billion by 2026, at a (CAGR) of 19.6%. It appears that automated loan approval systems are poised to become the future of the lending business.

This blog post delves into the impact of AI-powered automated loan approval systems on both borrowers and lenders, shedding light on the benefits and potential concerns associated with this technology.

Streamlining Loan Approvals with AI

Automated loan approval systems leverage AI algorithms and machine learning techniques to analyse vast amounts of data and make quick and accurate lending decisions. These systems utilise a range of data sources, including credit scores, employment history, income levels, and even social media activity, to assess a borrower’s creditworthiness. By automating the loan approval process, lenders can significantly reduce the time and effort required to evaluate loan applications, leading to faster decisions and improved efficiency.

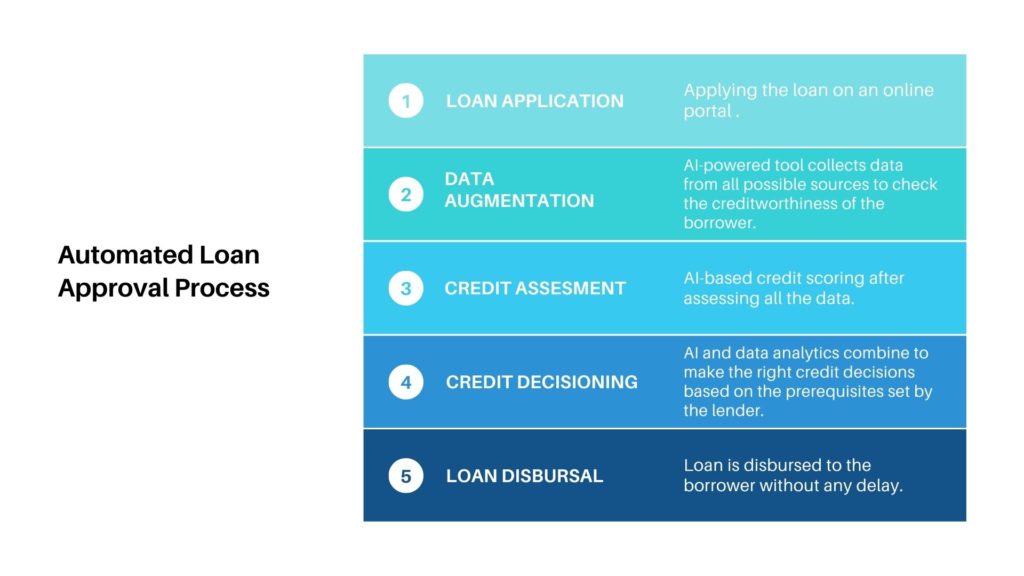

In operation, borrowers apply for loans on the lender’s portal by filling out the required details and submitting the necessary documents. Once the application is finalised, an AI-driven tool employed by the lender initiates data gathering from various sources to evaluate the borrower’s credit score. If the borrower’s application satisfies the lender’s requirements within the loan approval system, the loan is promptly approved, and the borrowers receive the requested funds without delay.

Corestrat’s Digital Lending Automation is one automated tool, which aids lending agencies in making well-informed decisions regarding risk management when granting credits. These tools, powered by AI and ML, possess the ability to analyse vast amounts of data and seamlessly integrate with any existing systems. By leveraging these tools, creditors can automate the lending process and enhance the borrowing experience for borrowers.

Benefits for Borrowers

Enhanced Speed and Convenience: One of the primary advantages of AI-powered loan approval systems is the speed at which decisions can be made. Borrowers no longer have to endure long waiting periods, as these systems can analyze data and provide instant feedback.

Increased Access to Credit: Automated loan approval systems have the potential to increase access to credit for individuals who may have previously been overlooked by traditional lending practices. By considering a broader range of factors and utilising alternative data sources, such as digital footprints and transaction histories, AI algorithms can evaluate creditworthiness more holistically. This can benefit borrowers with limited credit histories or unconventional income streams, providing them with opportunities they may not have otherwise had.

Improved Accuracy and Objectivity: AI-based loan approval systems can maintain a 95% accuracy rate and mitigate the risk of human bias that may exist in traditional lending processes. These systems make lending decisions based on objective data and predefined algorithms, reducing the potential for discrimination or favouritism. This objectivity ensures that loan approvals are based on merit and financial viability, rather than personal judgments or preconceived notions.

Benefits for Lenders

Enhanced Risk Assessment: AI algorithms excel at analysing vast amounts of data, enabling lenders to assess the creditworthiness of borrowers more accurately. By considering a wide range of variables and patterns, these systems can identify potential risks and predict repayment behaviours with higher precision. This ML-powered tool thus optimises credit risk and helps lenders make more informed lending decisions, reducing the likelihood of default and minimising financial losses.

Cost and Resource Efficiency: Automating the loan approval process with AI eliminates the need for extensive manual labour, paperwork, and administrative tasks. This significantly reduces operational costs and frees up valuable resources that can be allocated elsewhere within the organisation. Lenders can streamline their operations, lower overhead expenses, and optimise their workforce, resulting in improved profitability and a competitive edge in the market.

Compliance and Regulatory Adherence: Automated loan approval systems can help lenders ensure compliance with regulatory requirements and lending guidelines. The algorithms can be programmed to consider and evaluate the specific regulations, policies, and criteria set by regulatory bodies. This reduces the risk of non-compliance and potential penalties for lenders.

Potential Concerns and Considerations

While the adoption of AI-powered loan approval systems brings numerous benefits, it is important to address the potential concerns and considerations associated with this technology.

Data Privacy and Security: AI-powered systems rely heavily on personal and financial data to make accurate lending decisions. Ensuring the privacy and security of this sensitive information is crucial. Lenders must implement robust cybersecurity measures to protect data from unauthorised access, breaches, or misuse. Additionally, clear consent mechanisms and transparent data-handling practices should be in place to maintain the trust of borrowers.

Fairness and Transparency: One primary concern is transparency and explainability. Machine learning algorithms can be complex and difficult to interpret, making it challenging for borrowers to understand the reasoning behind loan approval or denial decisions. Lenders must ensure that their automated systems are transparent, providing clear explanations and disclosing the factors influencing the decision-making process.

Conclusion

Automated loan approval systems powered by AI have transformed the borrowing and lending landscape, providing efficiency, accuracy, and fairness to borrowers and lenders alike. The use of AI algorithms enables faster loan approvals, more accurate risk assessments, and unbiased decision-making.

Corestrat’s Digital Lending Automation aims to help lending institutions automate the lending process and make it smoother for both lender and the borrower. With the ability to garner and evaluate any amount of data, DLA can be the go-to tool for credit agencies to optimise their lending process.

Skip to content

Skip to content