Technology has been changing financial services for decades. Even leading technology companies, like Amazon and Google, have expanded their footprint in financial services across various scopes and approaches. The evolution of fintech technology has enabled non-financial institutions to offer financial services with the necessary licences and permissions.

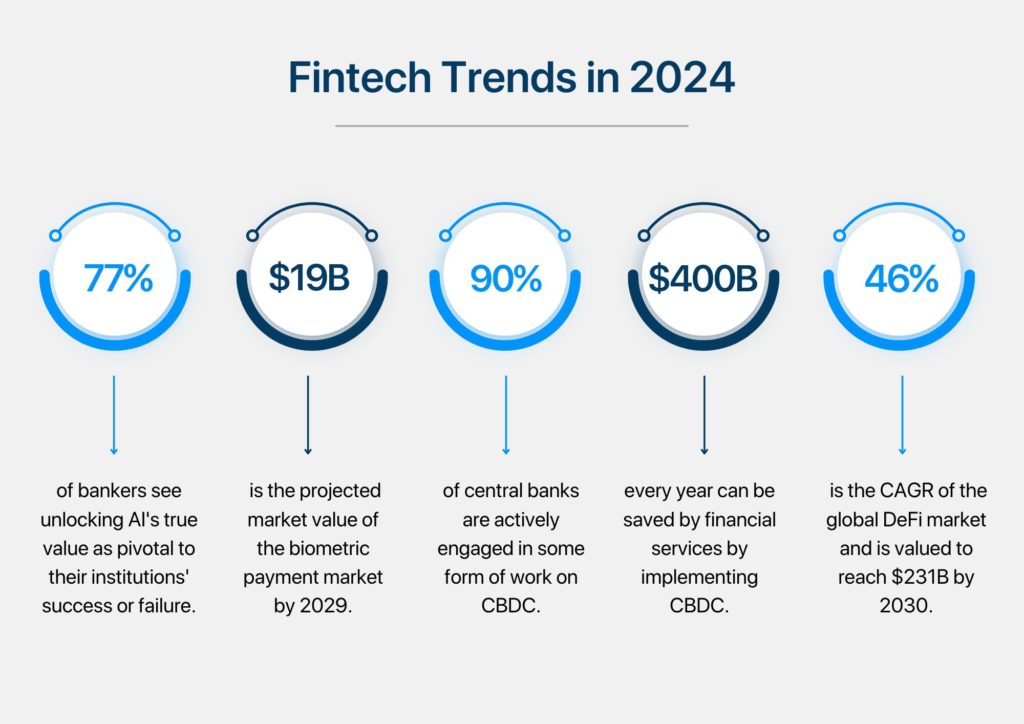

Adopting different technologies in their arsenal has brought about improvements in the speed and security of financial services, leading to an enhanced overall customer experience and increased service efficiency. According to reports from Temenos, 77% of bankers believe that the success and failure of their institutions will depend on unlocking the true value of AI. As we anticipate numerous innovations in financial technology, with the majority tied to AI, discussing the fintech trends of 2024 becomes highly relevant to understand better how the industry can further improve its service and offerings.

Generative AI in Fintech

Generative AI, pioneered in the 1960s, gained widespread usage in the early 2010s with the introduction of generative adversarial networks (GANs). McKinsey Global Institute estimates its potential value in banking to be between $200 billion and $340 billion annually, primarily through increased productivity. In financial services, generative AI finds various applications, including enhancing chatbot interactions, fraud detection, trading prediction, and risk modelling. Integrating generative AI offers substantial business benefits, potentially revolutionising customer service, personalised recommendations, and marketing scalability.

Central Bank Digital Currencies (CBDCs)

With nearly 90% of central banks actively involved in Central Bank Digital Currency (CBDC) development, it’s anticipated to revolutionise the financial services sector. Unlike decentralised cryptocurrencies, CBDC is a centralised digital form of national currency, controlled by the issuing central bank and functioning as legal tender. CBDCs spur fintech innovation, enabling user-friendly transactions and facilitating stable cross-currency exchanges while reducing operational costs associated with physical cash management. These currencies also incorporate anti-fraud measures within their digital infrastructure. Countries such as India, China, the USA, and Australia are pursuing CBDC adoption, potentially saving financial institutions $400 billion annually in direct costs by transitioning to digital finance.

Open Banking

Open banking enables third-party financial service providers to access consumer banking and financial data through APIs, fostering innovation in the banking sector. It empowers customers to securely share their data, promoting collaborative innovation. The global open banking market is projected to reach USD 128.12 billion by 2030, making it a significant trend in financial services. Through open banking APIs, customers benefit from personalised banking experiences, including tailored financial advice and product suggestions. This tailored approach enhances customer loyalty and satisfaction by aligning banking services precisely with their needs.

Biometric Payments

Maximize Market Research reports that the global biometric payment market was valued at $7.4 billion in 2022 and is expected to surpass $19 billion by 2029. This substantial growth positions biometric payment as a leading fintech trend in 2024, poised to transform the payment industry. Biometric payment utilises unique physiological or behavioural characteristics for authentication, replacing traditional methods like credit cards or PINs. Features such as fingerprints, facial recognition, and voice recognition enhance security and convenience, eliminating the need for physical cards or passwords. Biometric payment systems are increasingly prevalent across sectors like mobile payments, retail, and financial services, advancing secure and user-friendly payment methods.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is an emerging financial technology grounded in secure distributed ledgers, the same technology that forms the foundation of cryptocurrencies. With a value of USD 13.61 billion in 2022, the global DeFi market is expected to soar to $231.19 billion by 2030, boasting a CAGR of 46%. DeFi operates via smart contracts and public blockchains, offering financial products that differ from centralised finance by removing reliance on central authorities and institutions. By operating on peer-to-peer networks, DeFi aims to eliminate intermediaries like banks. Users gain enhanced control over their finances, enabling rapid asset transfers without third-party fees. Funds are converted into fiat-backed stablecoins accessible through digital wallets, bypassing traditional banking systems. This paradigm shift democratises financial access, extending services to nearly anyone with internet connectivity.

Conclusion

The financial services sector is transforming due to advancing technologies. Artificial Intelligence (AI) is set to be a pivotal force in the upcoming solutions, heralding a significant shift in the financial services landscape. The aforementioned technologies represent some of the emerging financial services trends in 2024, poised for continuous refinement to enhance their capabilities and better serve customers.

Corestrat, with its comprehensive suite of products in the form of digital lending automation and decision management suite, stands ready to enhance risk management and facilitate data-driven decision-making for entities operating in the financial services sector as they align with the emerging trends of 2024

For more details visit: www.corestrat.ai

Skip to content

Skip to content